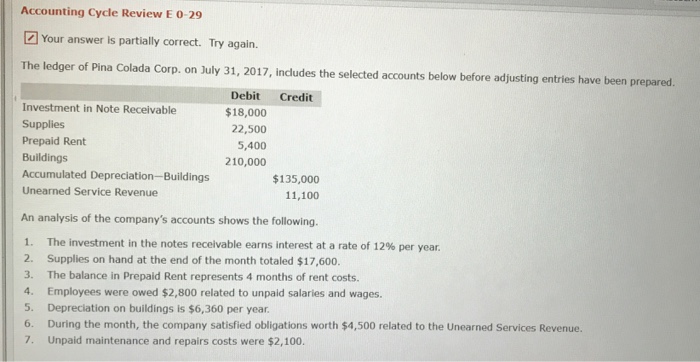

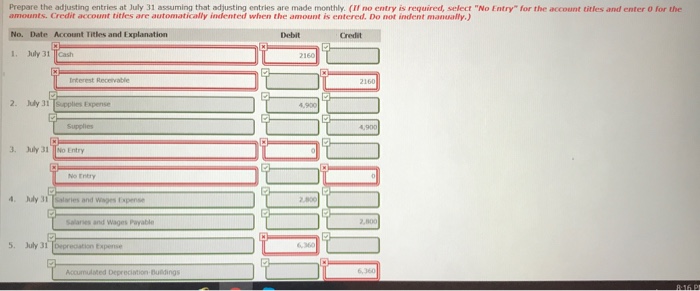

Accounting Cycle Review E 0-29 Your answer ls partially correct. Try again. includes the selected accounts below before adjusting entries have been prepared. Debit Credit Investment in Note Receivable Supplies Prepaid Rent Buildings Accumulated Deprecilation-Buildings Unearned Service Revenue $18,000 22,500 5,400 210,000 135,000 11,100 An analysis of the company’s accounts shows the following. I. The investment in the notes receivable earns interest at a rate of 12% per year. 2. Supplies on hand at the end of the month totaled $17,600. 3. The balance in Prepaid Rent represents 4 months of rent costs. 4. Employees were owed $2,800 related to unpaid salaries and wages. 5. Depreciation on buildings is $6,360 per year 6. During the month, the company satisfied obligations worth $4,500 related to the Unearned Services Revenue. 7. Unpaid maintenance and repairs costs were $2,100.